When it comes to money, I’ll admit, I have a love-hate relationship with the green. Rapper Biggie Smalls had it right when he said, “mo’ money mo’ problems.” But, I’ll add, no money still equals some hefty problems.

However, a person’s relationship with money is important. It shapes the way you use, save and invest it. As I get older, I’m more conscious of the way I handle my money and try my best to manage it the best way possible. Online tools like Mint.com and money-focused sites and blogs have helped, as well as events and forums that tackle the topic.

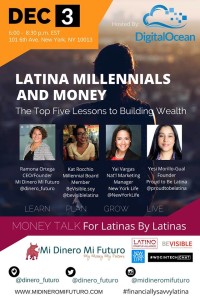

When I saw Mi Dinero Mi Futuro, a mission-driven financial-tech company that empowers Latinas to manage their money with confidence, was hosting an event, I knew I should attend. Held at Digital Ocean headquarters in New York City, moderator and MDMF founder Ramona Ortega and panelists, which included Yesi Morillo-Gual, founder of Proud to Be Latina; Kat Rocchio, Millennial Board Member at BeVisible.soy; and Yai Vargas, National Marketing Manager at New York Life, provided various tips for building wealth.

Here are five money tips every Latina should know:

Talk to your parents about what they have on their 401k, bank accounts, and property. pic.twitter.com/zsbNbWVVP5

— My Money My Future (@dinero_futuro) December 4, 2015

Have the hard conversations now. With my abuelos getting older, it’s natural for the family to think about their financial situation as they age. But what about our parents? It never crossed my mind. But each of the panelists agreed: While it’s a difficult conversation to have with parents, children need to know what their parents’ finances look like. Hypothetically speaking, if one or both of your parents died tomorrow, would you be able to locate all of their financial documents? Do you have access to their bank accounts, or can you account for their assets? Be sure to have that conversation with your parent(s), before it’s too late. Helpful tip: Scan all important documents and place on a USB or hard drive, in case of an emergency. Make sure you know where the docs are housed.

Life Insurance that fits your budget. Start with just $25 a month #midinero — My Money My Future (@dinero_futuro) December 4, 2015

Get life insurance. Don’t think you have to funnel thousands of dollars into a policy. You can scale it to fit your budget. The price point can go as low as $25 a month. Do know that the younger and healthier you are, the lower your premium will be.

It’s never too early to create a will. Don’t think it’s beyond your means. #midinero — Ain’t I Latina? (@aintilatina) December 4, 2015

It’s not too early to have a will. No, no one wants to think about his or her death, but it’s better to be proactive than reactive. You don’t have to wait until you have children, or are super ill, to write your will. You have various options from creating one online and getting it notarized to actually mailing it to yourself. The latter might be old school, but it’s still effective. Create one now!

Student Debt: pay on time and build you credit score but don’t put all of your money into paying it all off. #midinero

— My Money My Future (@dinero_futuro) December 4, 2015

Your student loan debt can wait…a bit

Yes, student loan debt it a pain in the culo. Some may even suggest you put the majority of your paycheck and funds toward paying this debt down. Not. So. Fast. The interest rate on student loans tend to be a lot lower than credit card rates, so if you’re going to pay off debt, focus on your credit cards. However, do always pay above your minimum, if you can, and on time.

Save!

Don’t skimp on the savings. You never know when these funds will come in handy.

ALSO, consider a joint household budget and not necessarily a joint account. <– ❤ this tip! #midinero

— Ain’t I Latina? (@aintilatina) December 4, 2015

Bonus: Have you ever considered a joint household budget as opposed to a joint bank account? Yes, that’s right! If you’re married (or engaged), don’t think you’re confined to an account you share with your partner. You can work together on a joint household budget, and keep your separate accounts.

For more financial insights, check out the hashtag #midinero for gems from the event. Also, visit midineromifuturo.com for regular financial and wealth-building info.

Let us know what you do to keep your finances in order in the comments section below.